Health of Residential Rental Market at Pre Pandemic Levels

What is the consensus by the experts for the residential rental market in the near future?

The insights provided by Joseph Yun and Elliot Eisenburg during the Instant Reaction session on December 19, 2023, extend beyond the immediate implications for homebuyers. The dynamics of housing starts and the importance of accurate data also bear significant consequences for the residential rental market.

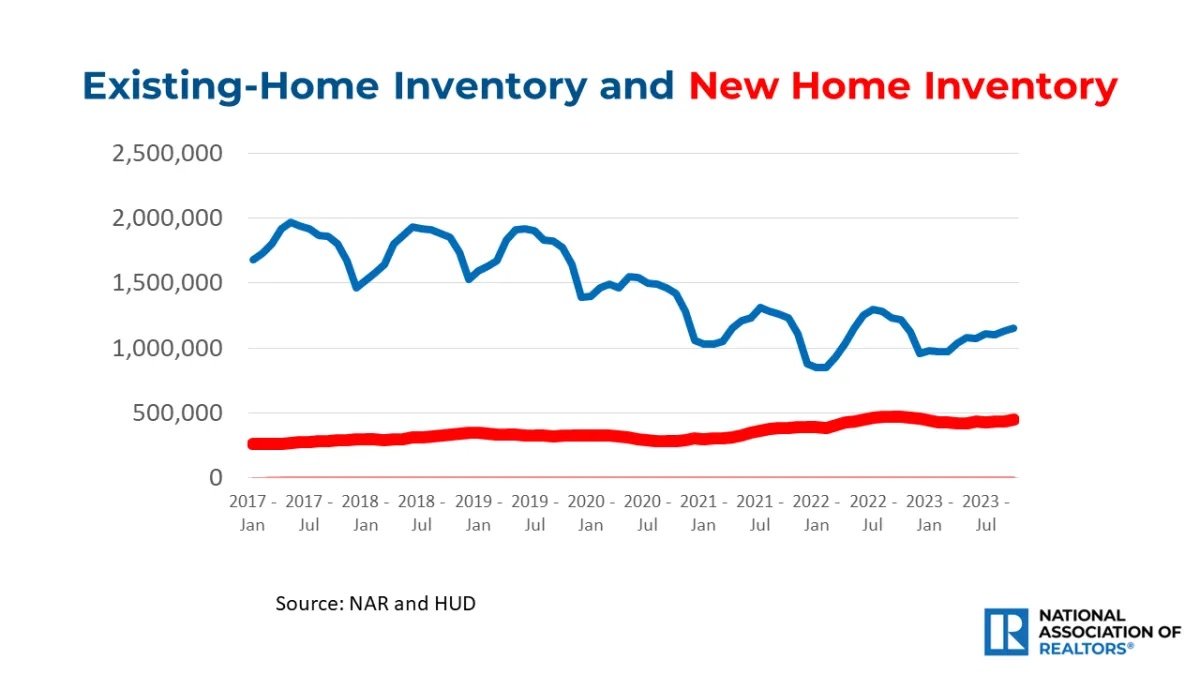

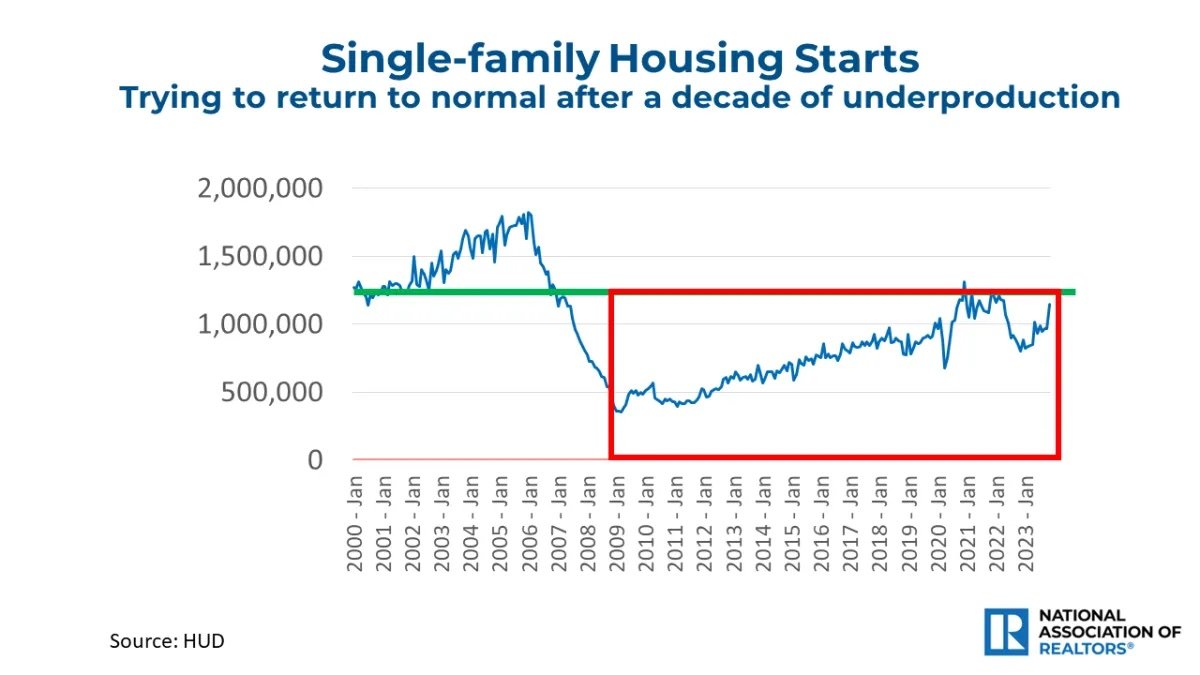

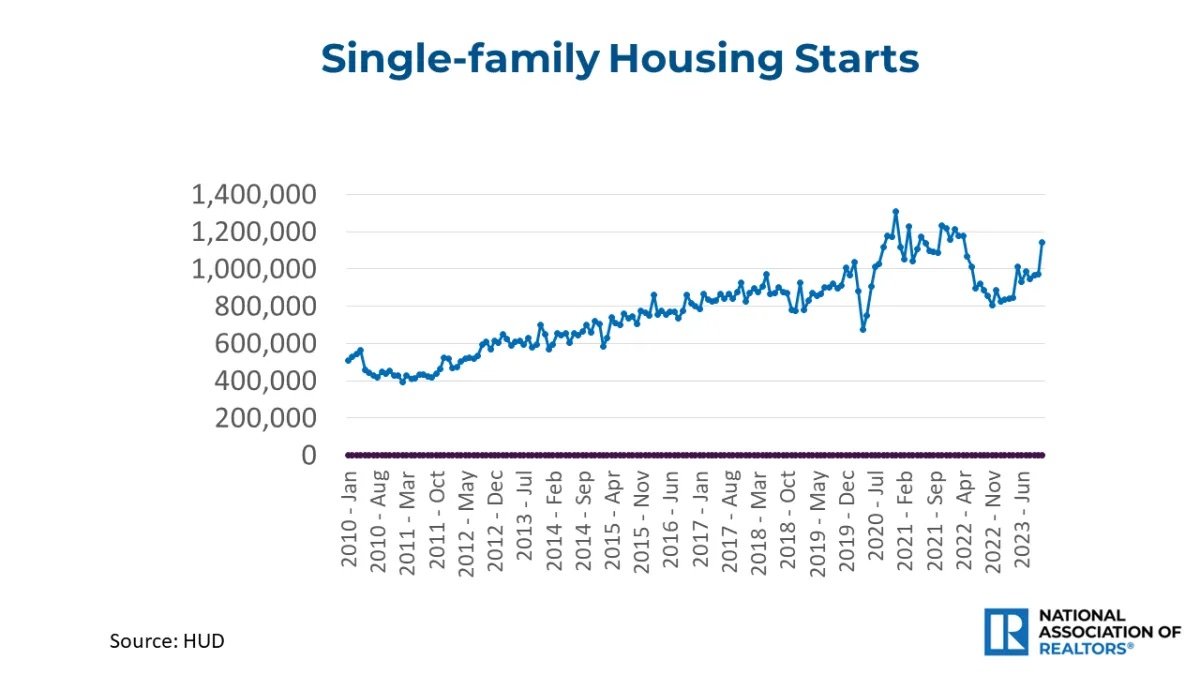

Housing starts, as discussed by Yun, play a pivotal role in determining the overall supply of housing units. As new construction projects increase, the potential for a more balanced supply and demand scenario arises. This equilibrium not only affects homebuyers but also has a ripple effect on the residential rental market. An increase in housing starts can alleviate pressure on the rental market by offering more housing options, potentially curbing rental price inflation.

In many regions where housing demand has outpaced supply, residential rental prices have surged, making it difficult for tenants to find affordable housing. The imbalance between supply and demand, highlighted by Yun, has contributed to this rental affordability challenge. However, if the increased housing starts materialize as projected, a more balanced market could emerge, offering relief to both potential homebuyers and renters.

Furthermore, Eisenburg's emphasis on accurate data has direct implications for the rental housing market. Timely and reliable information is crucial for property managers, investors, and policymakers to make informed decisions about rental pricing, property development, and housing policies. Data delinquency, as highlighted by Eisenburg, could lead to misinterpretations of rental market conditions, potentially resulting in suboptimal policy responses and investment decisions.

Looking ahead to 2024, the cautious optimism expressed by Yun and Eisenburg suggests a potential positive shift in the housing market, with increased housing starts playing a key role. If this optimism translates into reality, the rental market could witness improved affordability and a more stable pricing environment. As the market dynamics evolve in response to increased housing starts and improved data accuracy, both homebuyers and renters stand to benefit from a more balanced and transparent housing market in the coming year.