San Antonio Rental Return on Investment Calculator

Introduction

Investing in rental properties is a smart way to build long-term wealth, but how do you know if your property is actually making money? That’s where using the San Antonio Rental Return on Investment Calculator comes in.

Your ROI (Return on Investment) helps you measure whether your rental is profitable or just an expensive headache. But here’s the catch—many investors miscalculate their ROI by forgetting key expenses like maintenance or property management fees. Others overlook critical factors like cash flow and cap rate, both of which can make or break a deal.

In this guide, we’ll break down how to use the San Antonio Rental Return on Investment Calculator, explain why cap rate and cash flow matter, highlight common mistakes to avoid, and show you how to simplify it all with our free rental investment calculator.

Ready to Find Out Your ROI?

Before we dive in, why not take the guesswork out of the equation? Use our free San Antonio Rental Return on Investment Calculator to crunch the numbers in seconds!

Table of Contents

What is ROI in Rental Property?

ROI (Return on Investment) is the percentage of profit you earn compared to the amount of money you’ve invested. It tells you whether a rental is a money-maker or a dud.

A good ROI depends on your market and investment strategy, but generally:

✅ 8-12% is solid for long-term rentals

✅ 15%+ is ideal for short-term rentals like Airbnb

How to Use the San Antonio Rental Return on Investment Calculator

1. Determine Your Total Investment

This includes:

✔ Down payment

✔ Closing costs

✔ Renovation expenses

✔ Any upfront fees (inspections, legal fees, etc.)

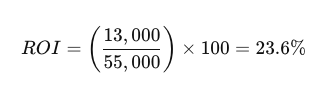

For example, if you buy a property for $200,000 with a 20% down payment ($40,000), plus $5,000 in closing costs and $10,000 in renovations, your total investment is $55,000.

2. Calculate Your Annual Rental Income

Take the total rent you collect in a year:

Example: If you charge $1,500/month, that’s $18,000/year in rental income.

3. Subtract Operating Expenses

Common expenses include:

Property taxes

Insurance

Maintenance & repairs

Property management fees

HOA fees (if applicable)

Say these total $5,000/year, leaving you with a net income of $13,000.

4. Use the ROI Formula

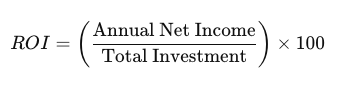

Basic ROI Formula:

For our example:

That’s a great ROI! But what if you financed the property?

5. Understanding Cap Rate and Cash Flow

What is Cap Rate?

Cap rate (capitalization rate) is another way to measure a rental property’s profitability, but it ignores financing and focuses purely on the property’s income potential.

Cap Rate Formula:

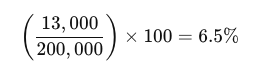

If your net income is $13,000 and the purchase price is $200,000:

A 6-8% cap rate is common in stable rental markets.

Why Cash Flow Matters

Cash flow is your actual profit after covering expenses. A property with a high ROI but negative cash flow can still be risky, especially in an economic downturn.

If your monthly expenses (mortgage, taxes, insurance, maintenance, etc.) are $1,500 and your rental income is $1,700, you have:

Common Mistakes Investors Make

Even experienced investors mess up their ROI calculations. Here are the biggest mistakes to avoid:

❌ Forgetting Maintenance Costs

Owning a rental isn’t just collecting checks. Repairs, appliance replacements, and general upkeep add up. A good rule of thumb is to set aside 1-2% of the property’s value annually for maintenance.

❌ Ignoring Property Management Fees

If you’re not managing the property yourself, property management fees (typically 8-12% of rent) need to be included in expenses.

❌ Not Factoring in Depreciation

Depreciation affects your tax situation and long-term gains. While it doesn’t impact cash flow immediately, it matters when you sell the property.

❌ Overestimating Occupancy Rates

If you assume your property will be rented 100% of the time, you’re setting yourself up for disappointment. Budget for a 5-10% vacancy rate.

❌ Ignoring Cap Rate and Cash Flow

A high ROI doesn’t always mean good cash flow. Always check the cap rate to compare rental properties.

Why ROI Matters for Real Estate Investors

Knowing how to use the San Antonio Rental Return on Investment Calculator helps you:

✔ Compare rental properties before buying

✔ Decide whether to keep, sell, or refinance

✔ Build long-term wealth with smart investments

If your ROI is too low, adjust your strategy—increase rent, cut expenses, or refinance.

Conclusion

Understanding how to calculate return on investment for rental property is key to making smart investment decisions. Whether you’re a first-time landlord or an experienced real estate investor, getting the numbers right means better profits and fewer surprises.

Want to skip the math? Try our free San Antonio Rental Return on Investment Calculator to instantly check your ROI!

Frequently Asked Questions-FAQs

-

The simplest way to calculate ROI on a rental property is to subtract annual operating costs from annual rental income and divide the total by the mortgage value.

-

The 2% rule in real estate investing is a guideline suggesting that a rental property should generate monthly rental income equal to or exceeding 2% of its purchase price to be considered a potentially profitable investment.

-

A good profit margin for a rental property typically falls between 8% and 12% return on investment (ROI), although some investors aim for even higher returns depending on their goals and the market conditions.

-

A good cash flow for a rental property is generally at least 10% of the property's purchase price annually. This means that the property generates more income than it does expenses.