Keep Current: The Master San Antonio Rental Market Report

The San Antonio rental market is buzzing with energy, revealing an evolving landscape that can make or break investment strategies. Dive in with us as we uncover the numbers and narratives shaping San Antonio’s rental scene, and find out what opportunities lie on the horizon. For the purposes of this data collection, we have limited the search results to San Antonio, Texas proper. Single family refers to single family homes and garden homes. Multifamily refers to duplexes, triplexes, and quadraplexes. Condos and townhomes have been condensed into one category.

Table of Contents

November 2025 San Antonio Residential Rental Market Report

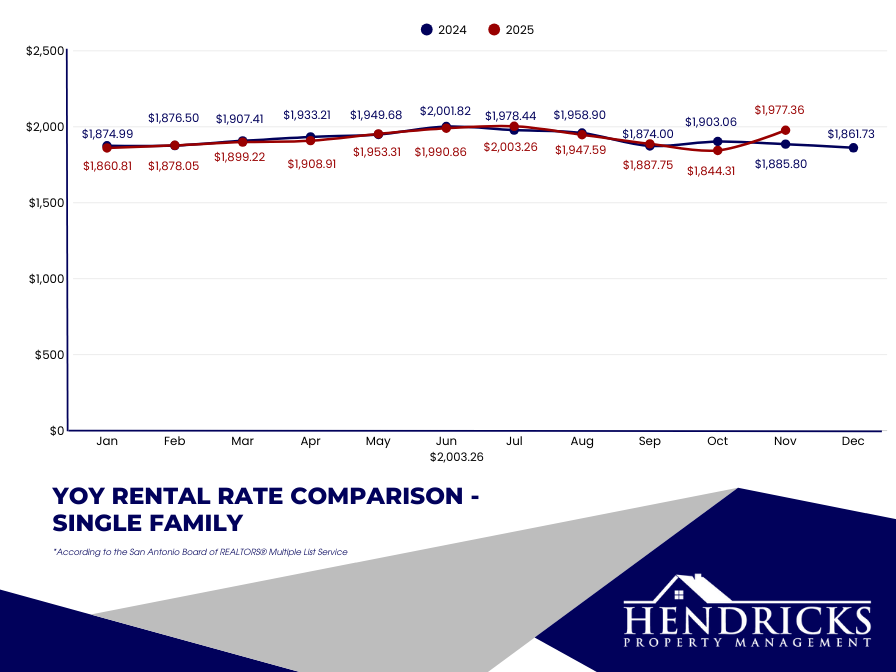

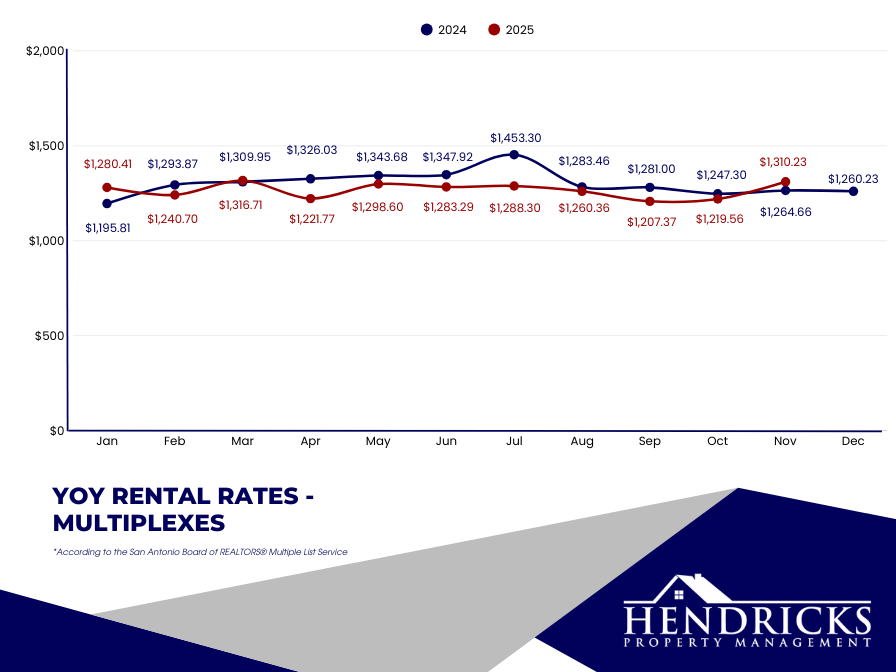

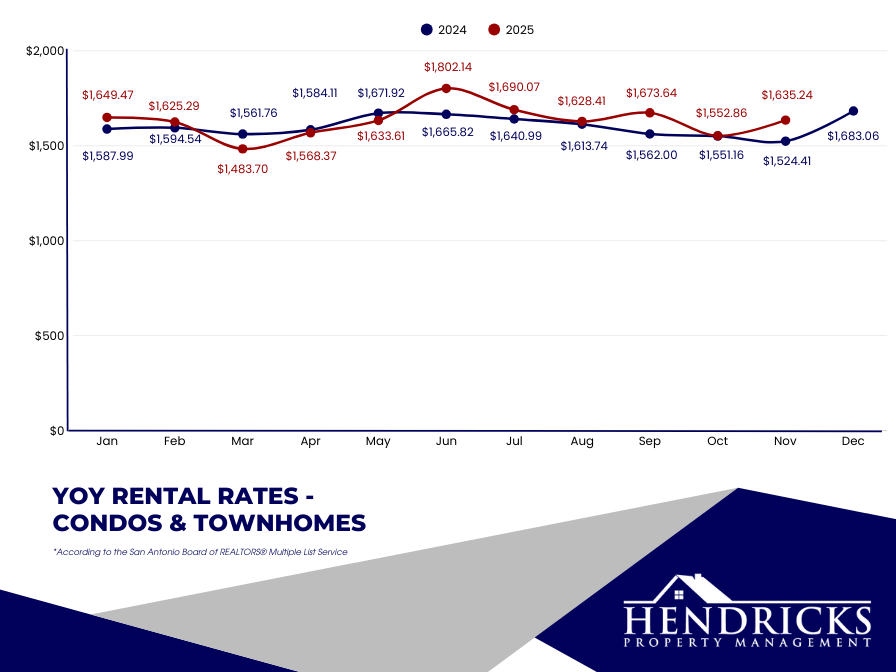

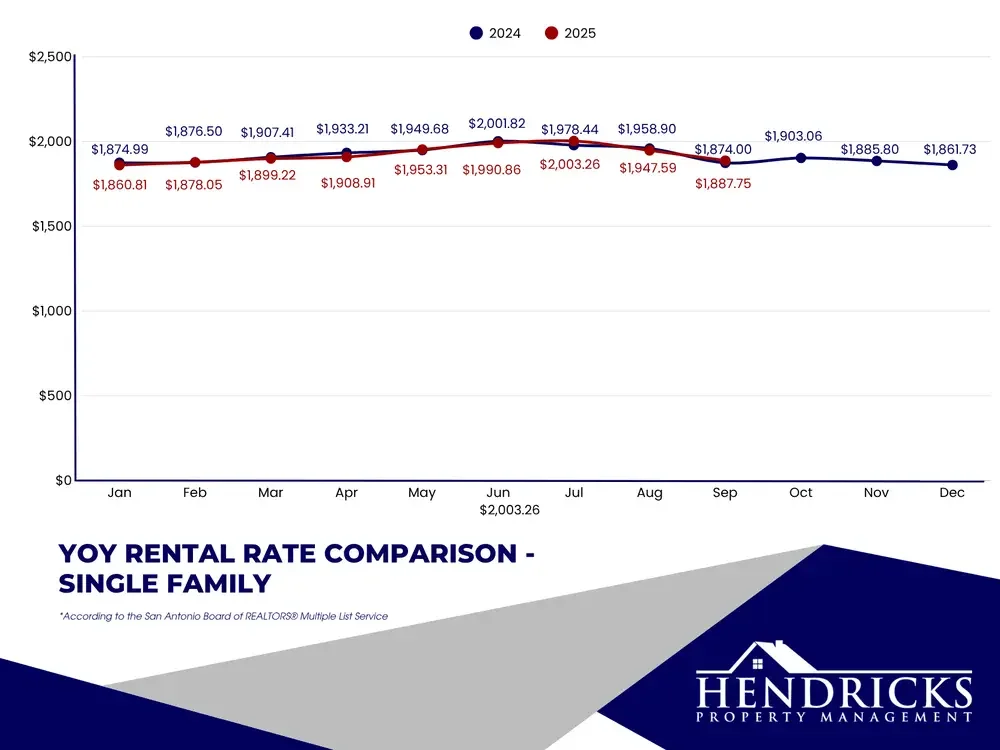

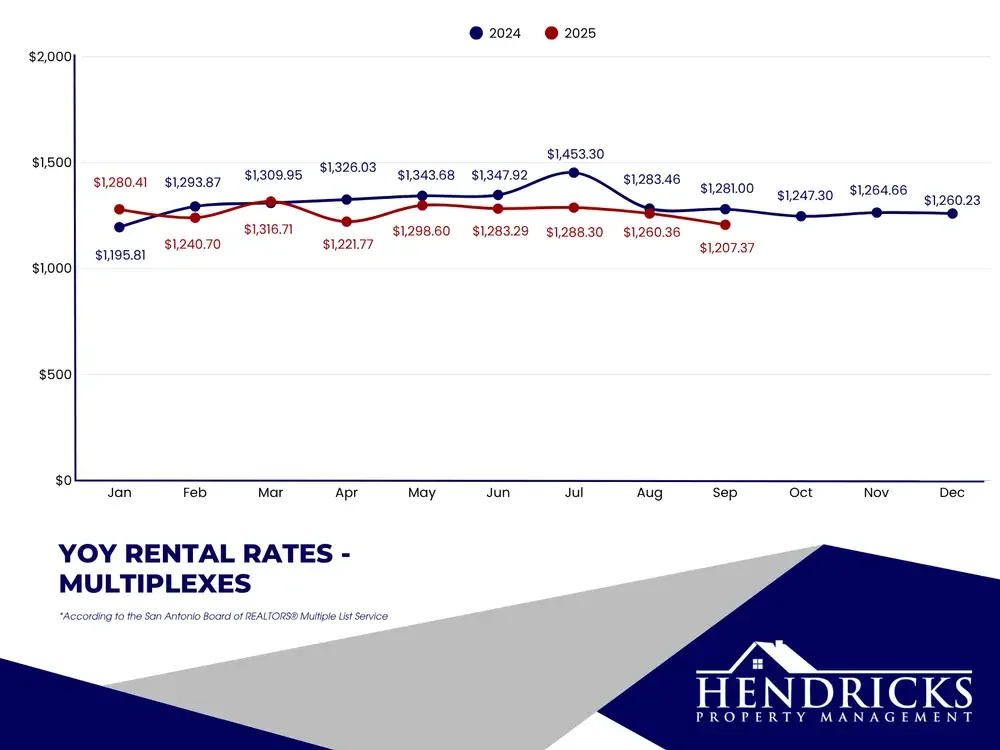

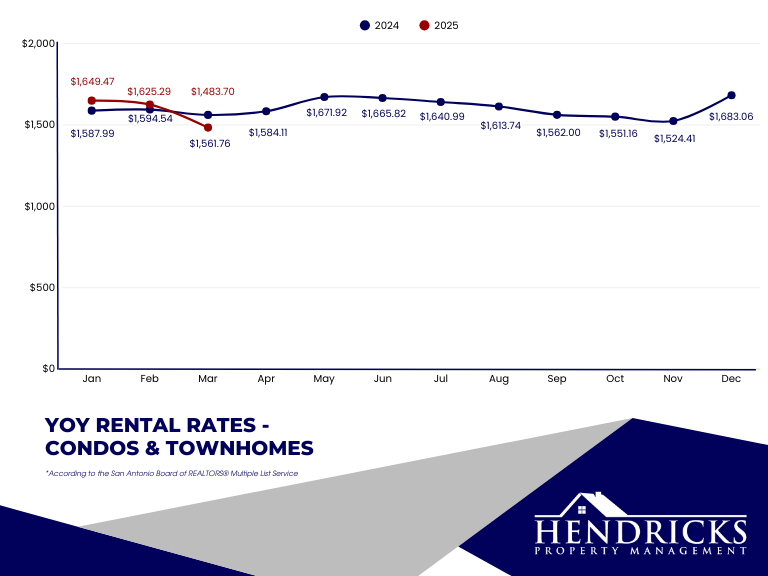

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

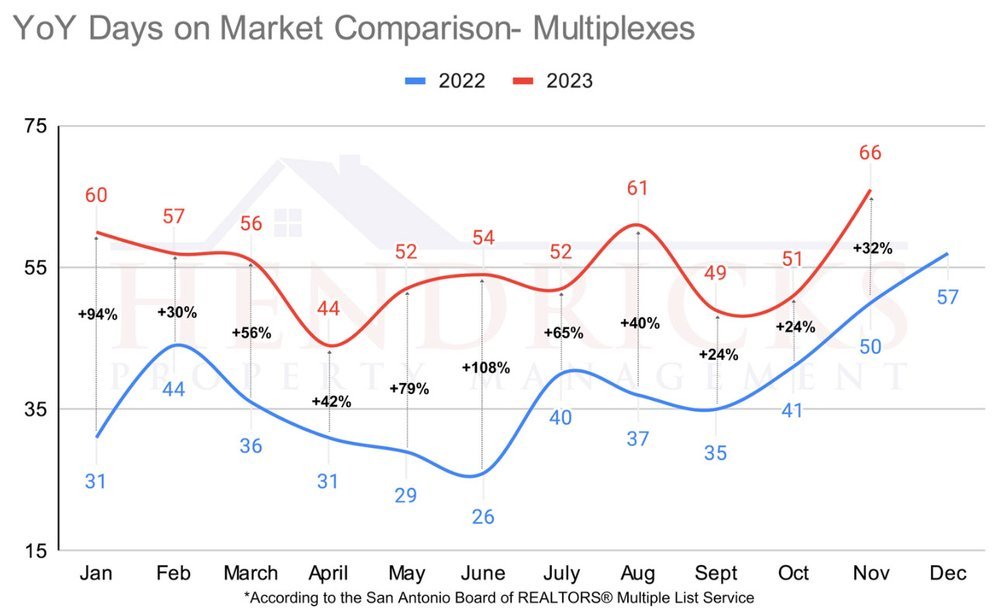

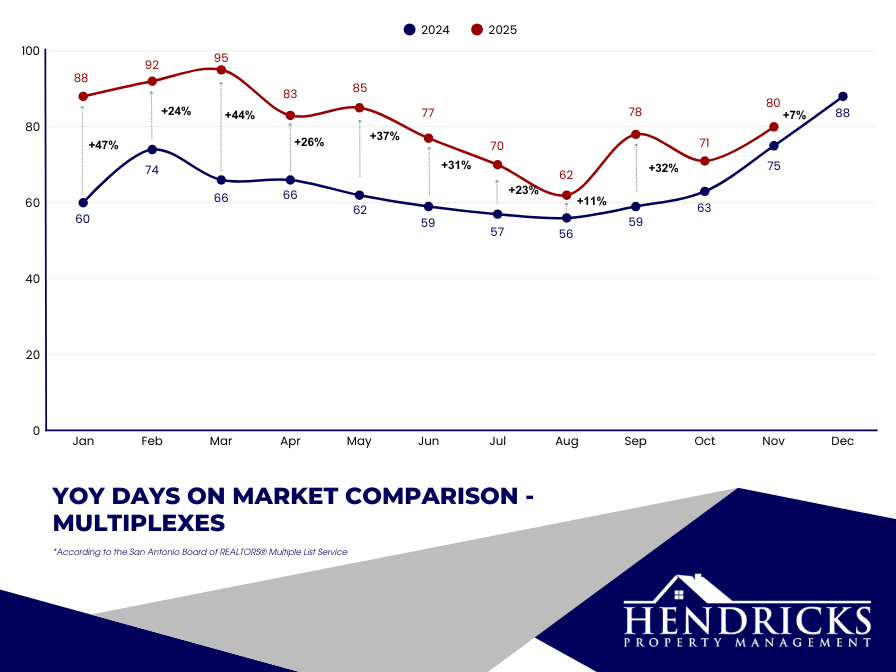

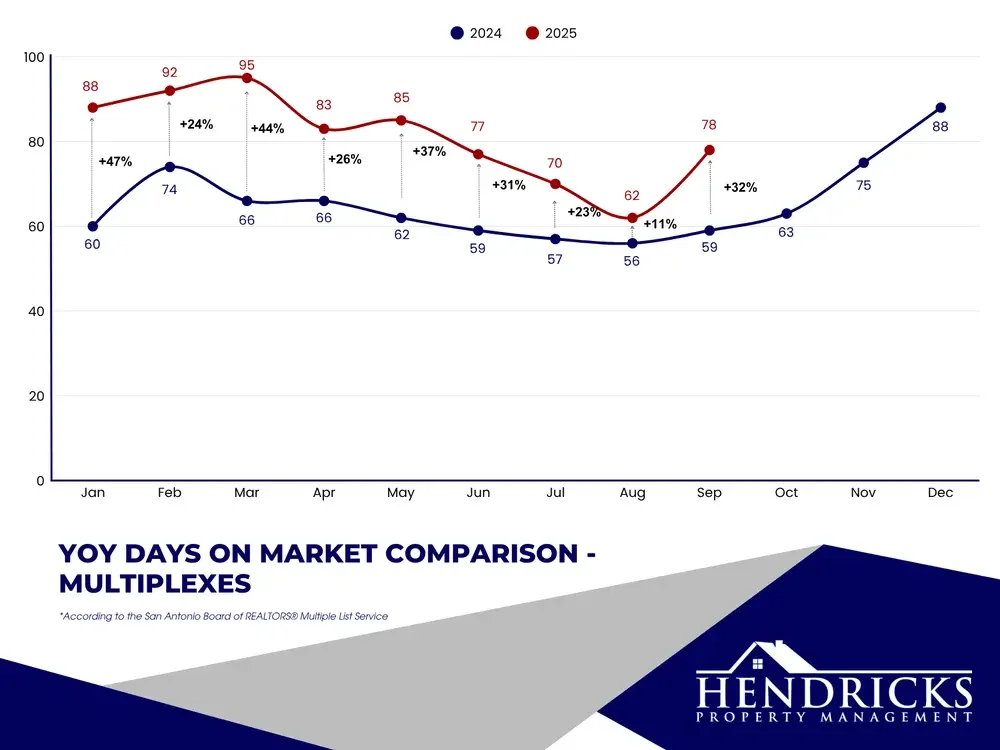

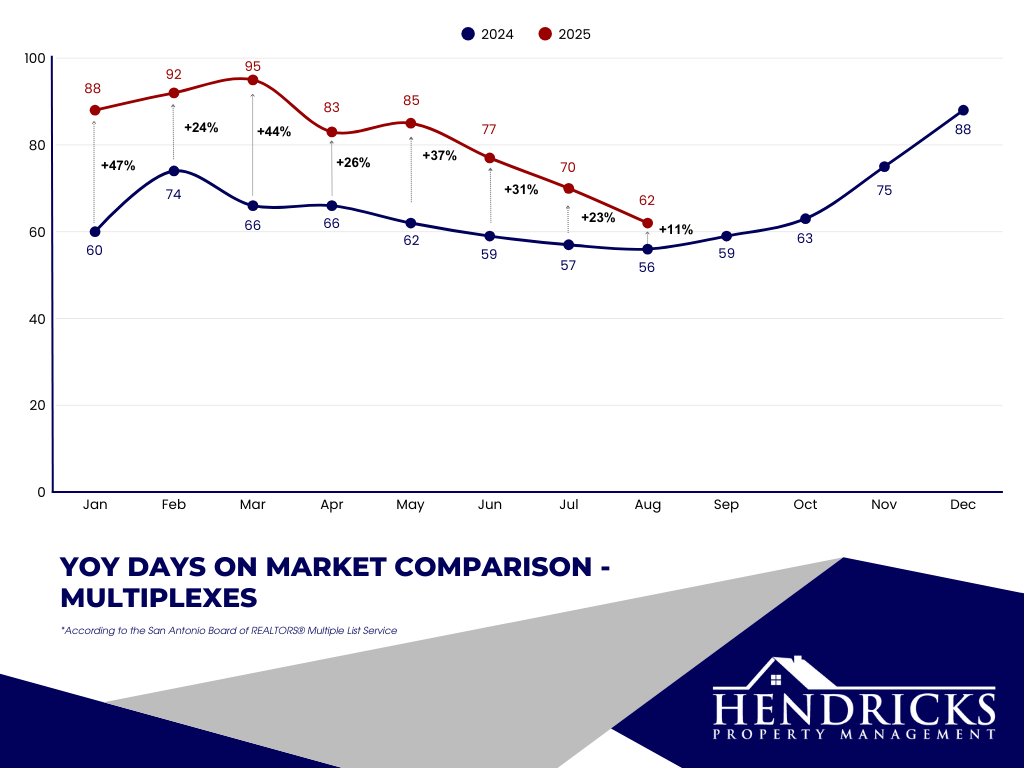

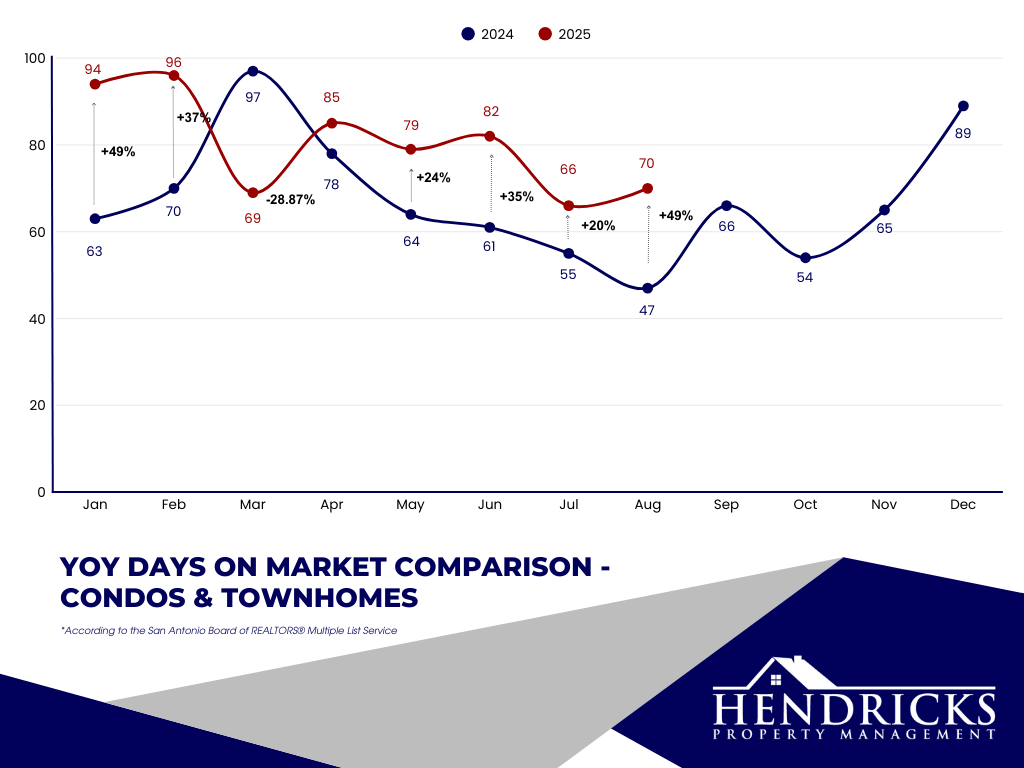

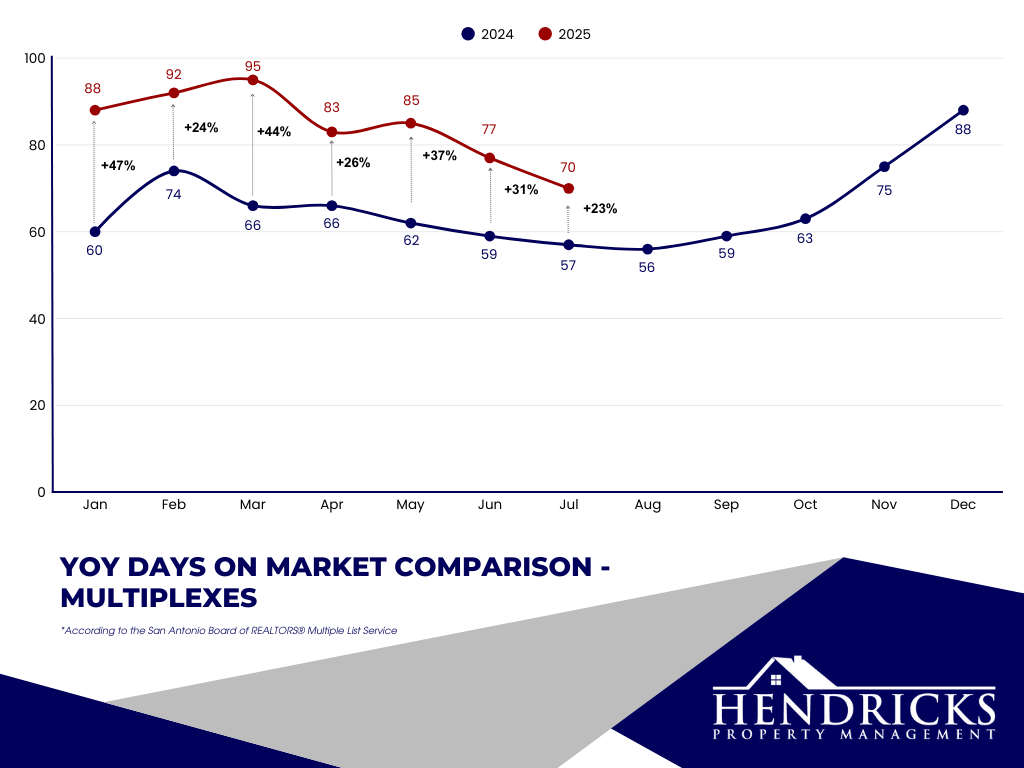

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

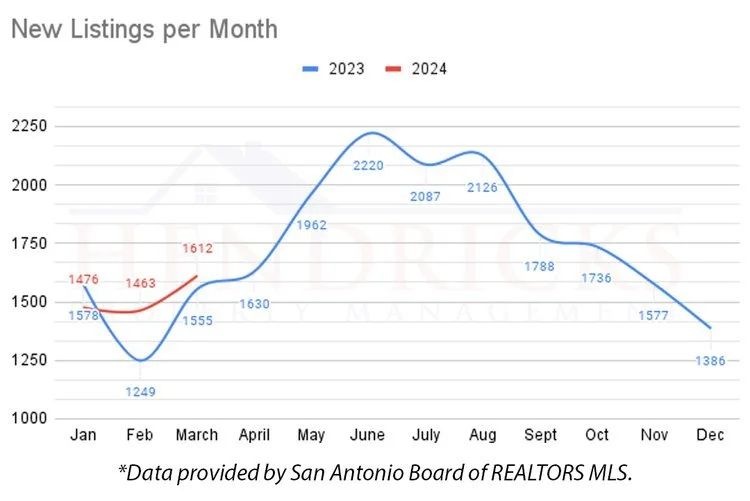

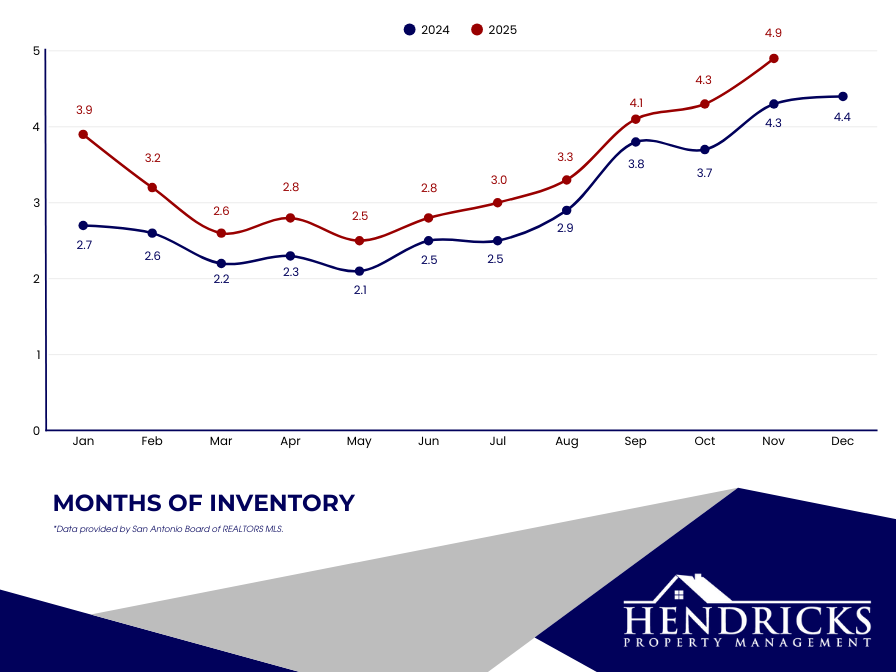

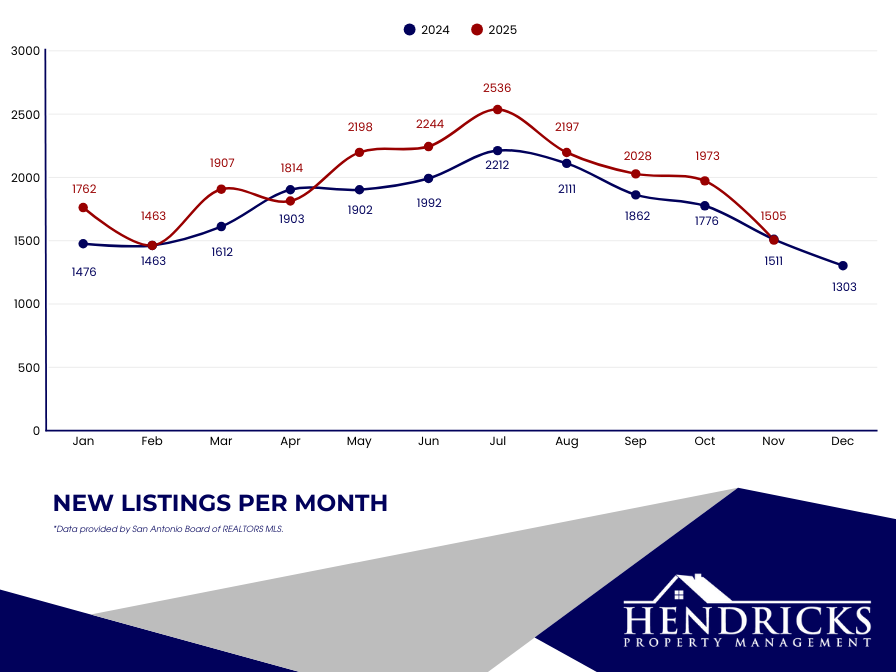

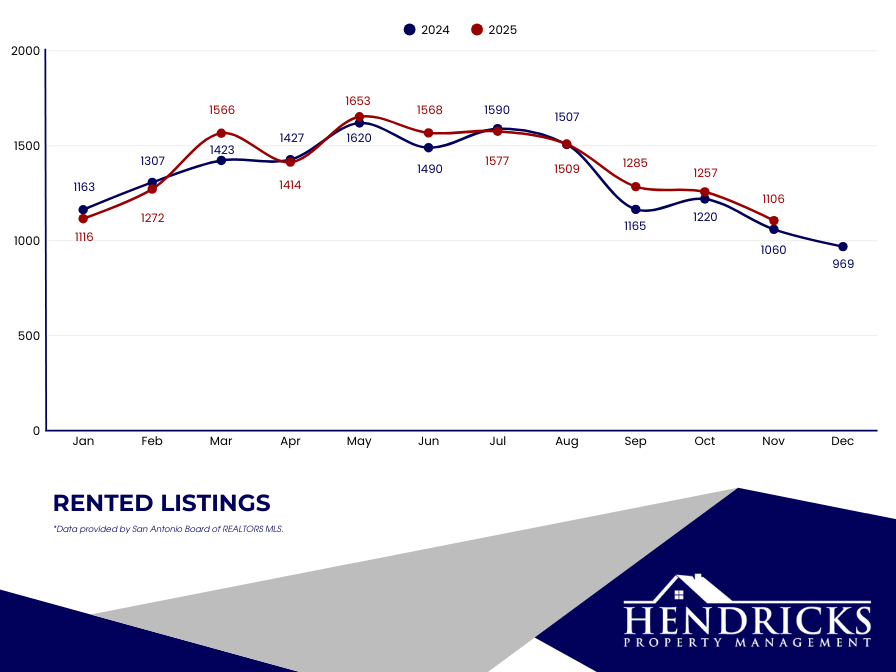

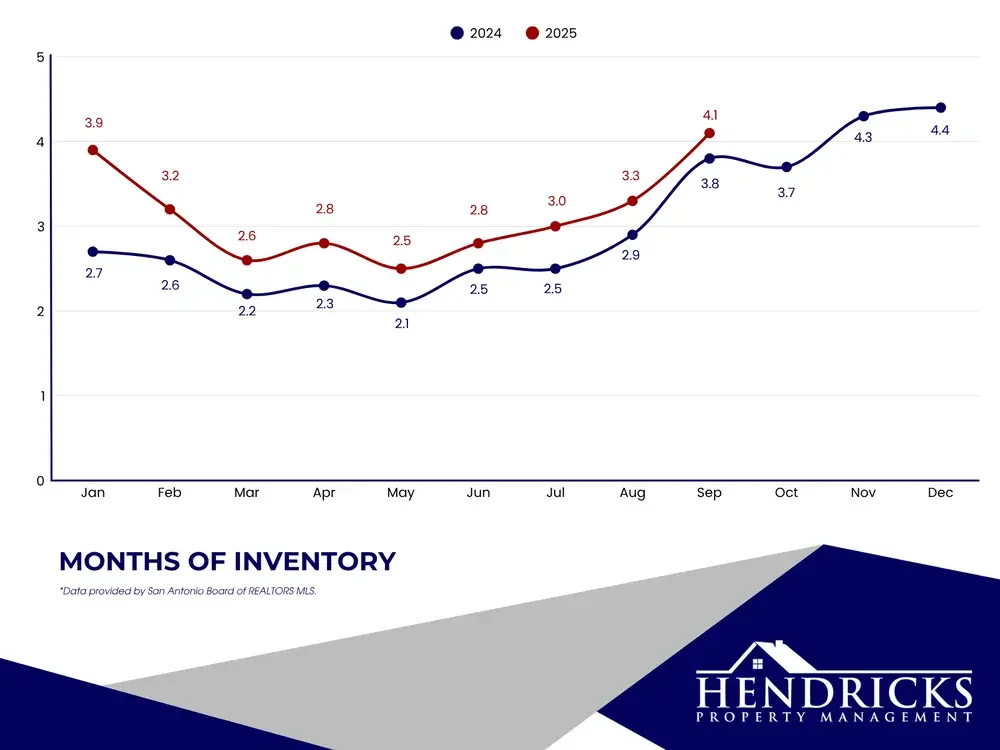

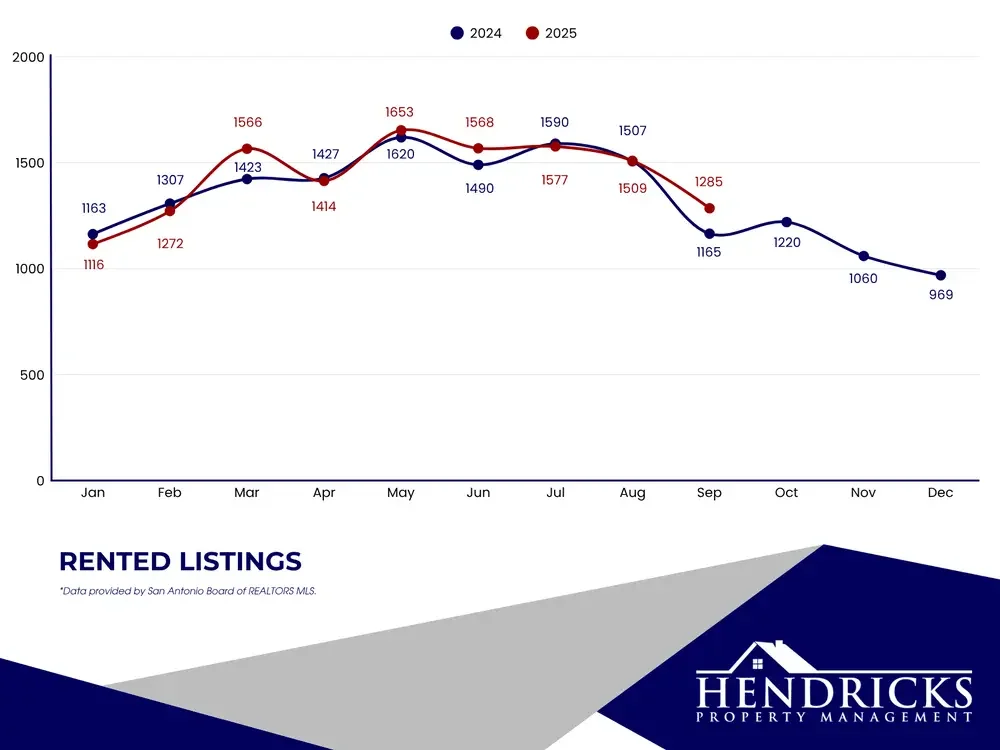

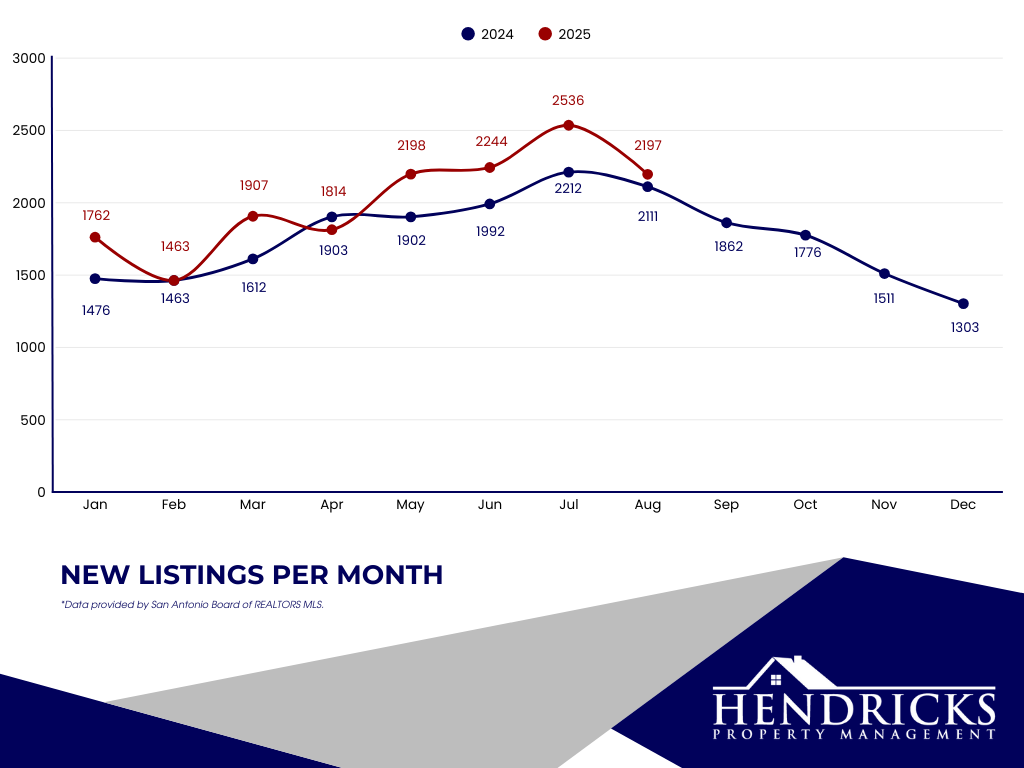

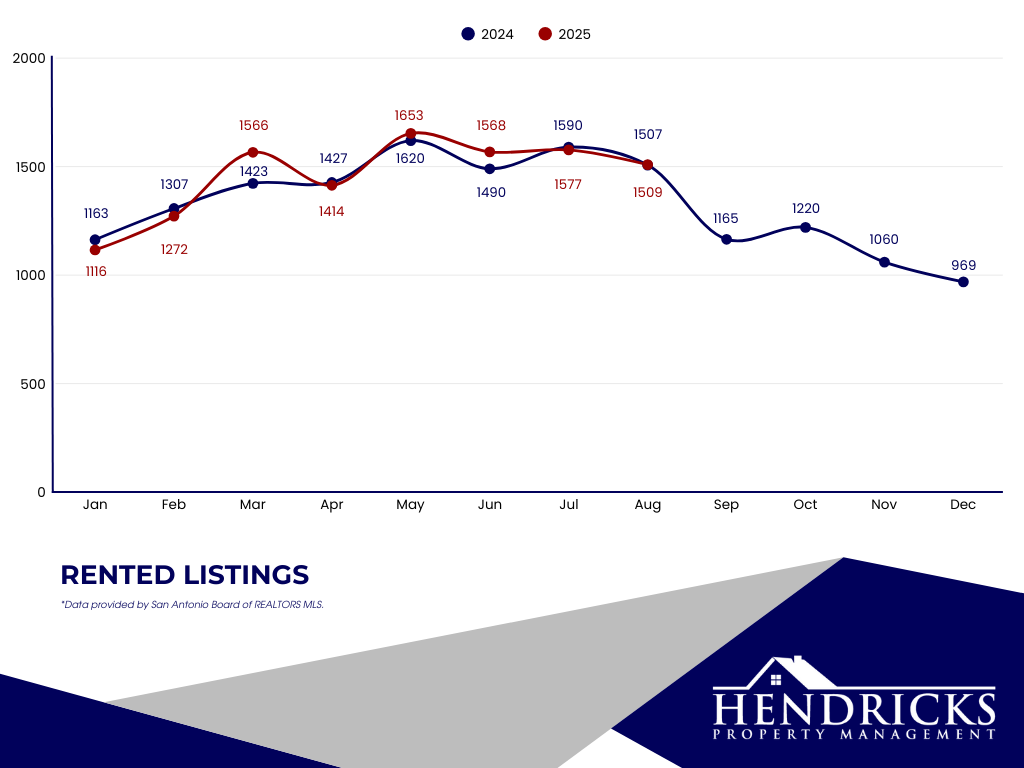

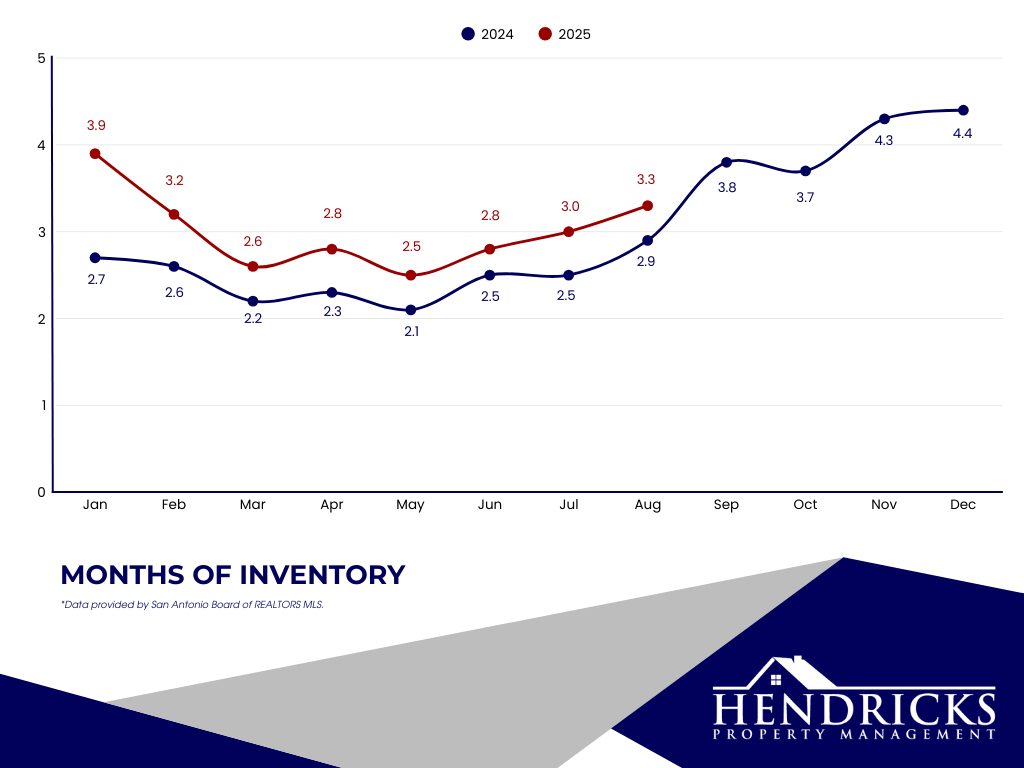

Months of Inventory, New Listings, Active Listings, and Rented Listings

Ready to take the leap? Connect with us to see how we can help.

October 2025 San Antonio Residential Rental Market Report

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

September 2025 San Antonio Residential Rental Market Report

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

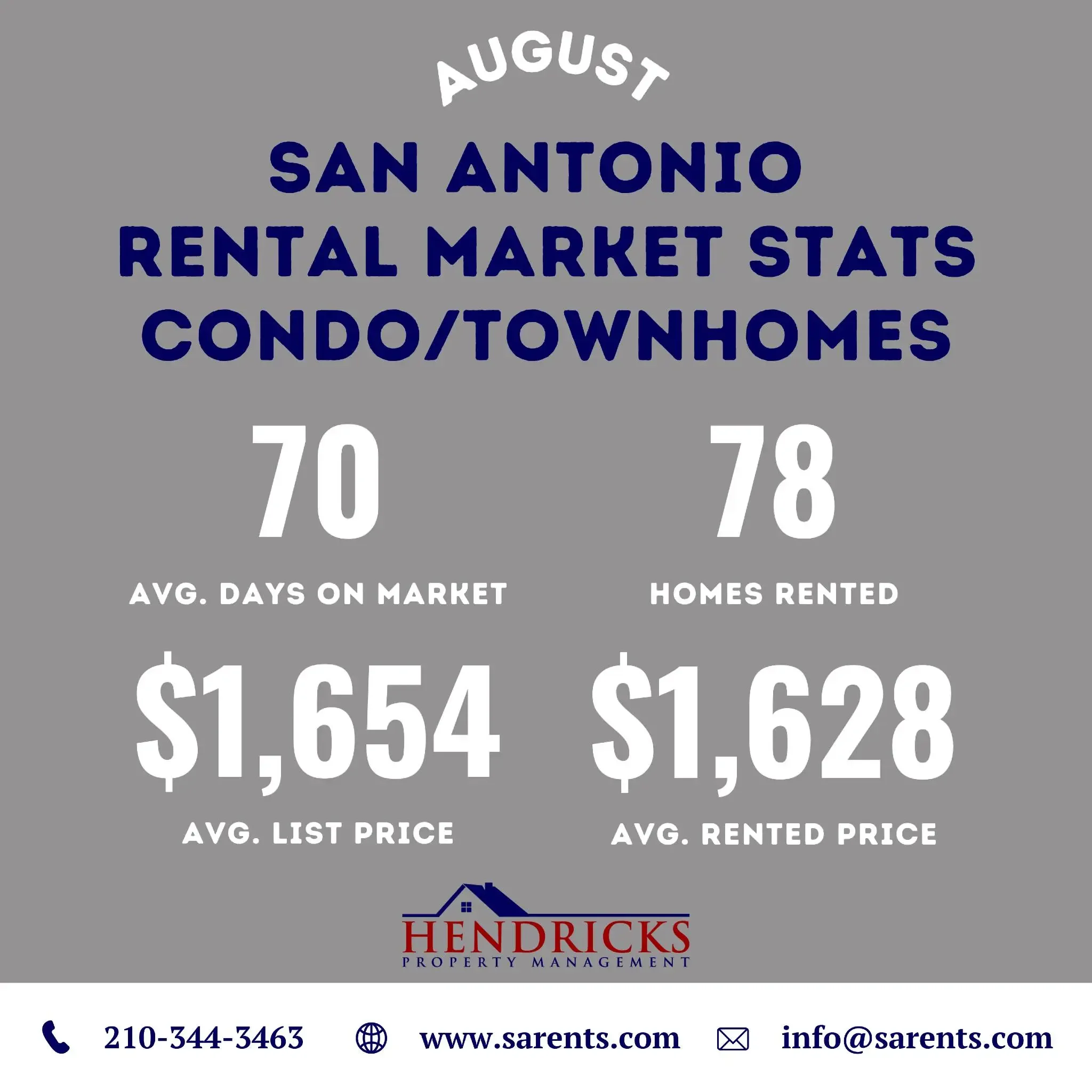

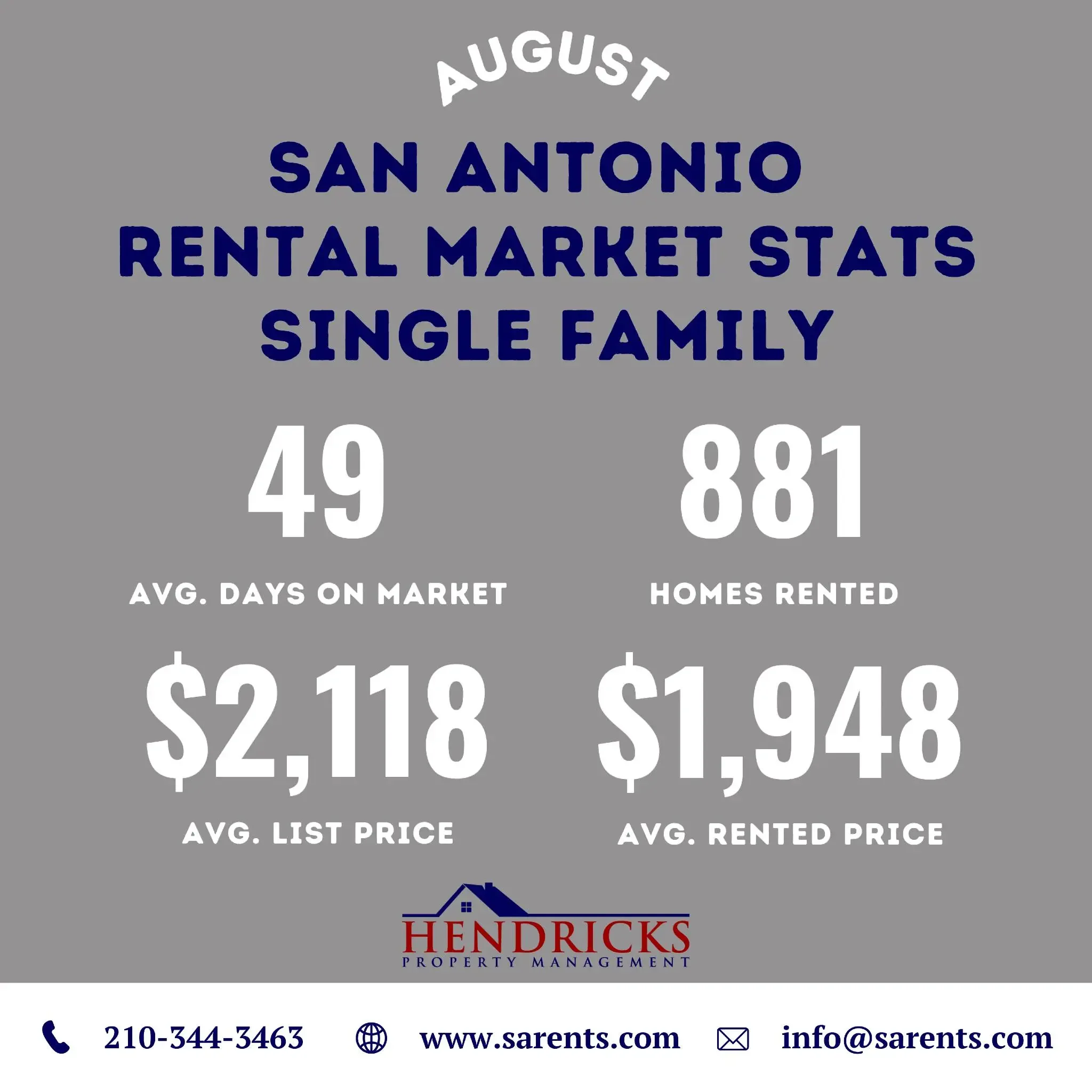

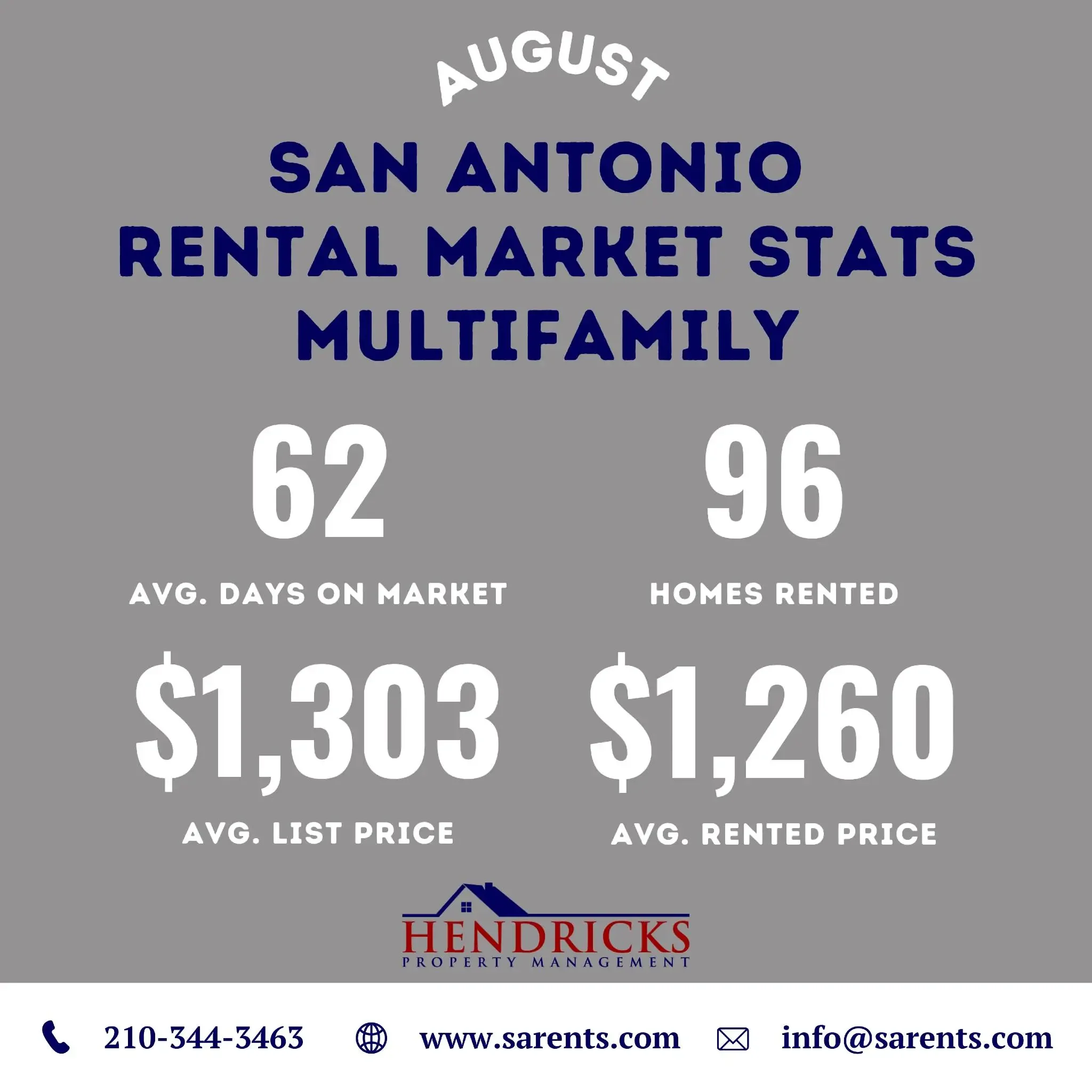

August 2025 San Antonio Residential Rental Market Report

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

July 2025 San Antonio Residential Rental Market Report

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

June 2025 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

May 2025 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

April 2025 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

March 2025 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

February 2025 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

Months of Inventory, New Listings, Active Listings, and Rented Listings

January 2025 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

December 2024 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

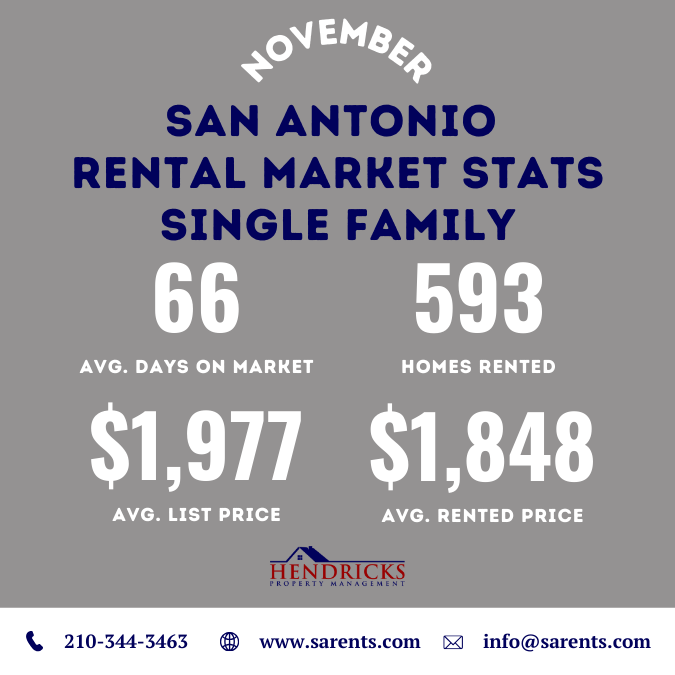

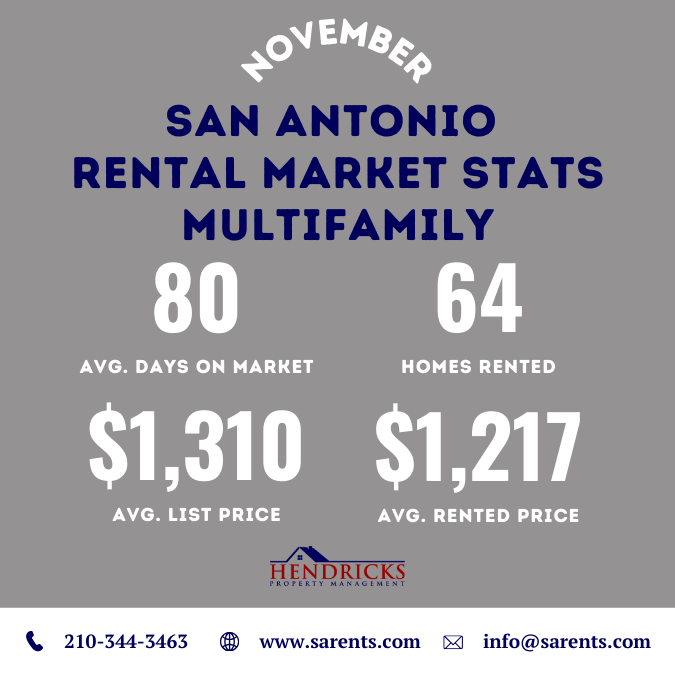

November 2024 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

Published November 21, 2024

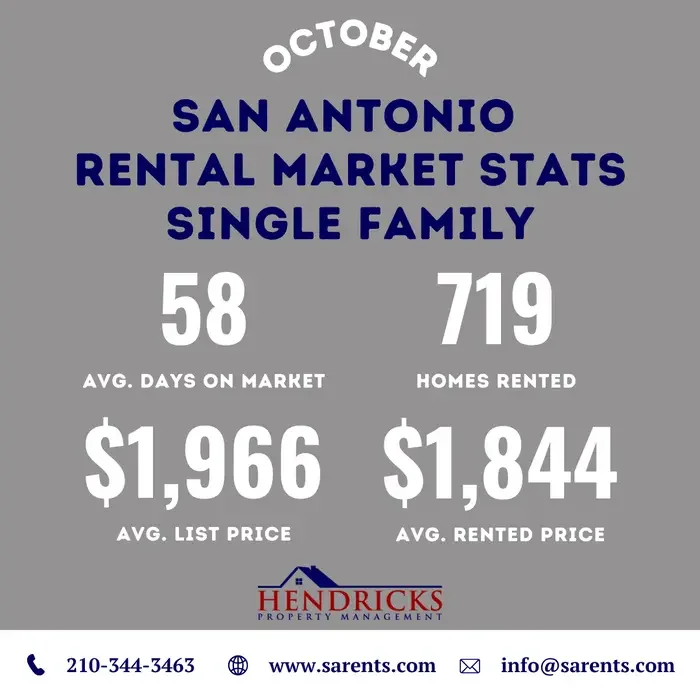

October 2024 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

Published October 16, 2024

September 2024 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

Published September 13, 2024

August 2024 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

Published August 26, 2024

July 2024 San Antonio Residential Rental Market Report

Days on Market for Single Family, Multifamily, and Condos or Townhomes.

Rental Rates for Single Family, Multifamily, and Condos or Townhomes.

Months of Inventory, New Listings, Active Listings, and Rented Listings

Published July 17, 2024

June 2024 San Antonio Rental Market Research

Let's explore the key statistics and trends that defined the San Antonio rental market research for the month of June 2024. The San Antonio rental market exhibited notable trends and statistics in June 2024. With a dynamic mix of single-family homes, multifamily units, condos, and townhomes, the market provides valuable insights for real estate investors.

If you don’t want to get into the nitty gritty, here’s a high level view of what the June 2024 San Antonio Rental Market looks like.

Here we’ll take an in depth look at each housing type with year over year comparison, and then look at the overall market with some key takeaways.

Days on Market

Rental Rates

General Market Health Indicators

Trends and Changes in the San Antonio Rental Market

One significant trend in the San Antonio rental market research is the noticeable decrease in active listings. Compared to the same time last year, active listings have dropped by 19.89%. This reduction reflects a tightening market, which can influence rental prices and availability.

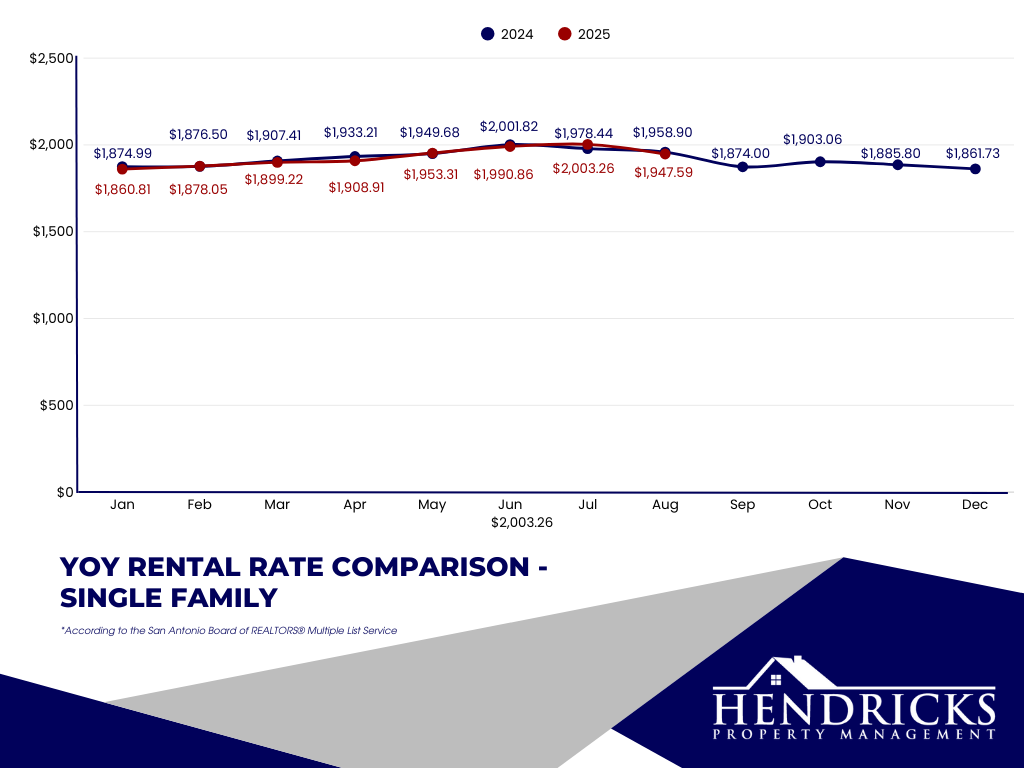

Stability in Single-Family Rentals

Single-family homes in San Antonio continue to demonstrate stability, with an average rental rate of $2,001.82 and no year-over-year change in days on market. This makes single-family rentals an attractive option for both investors and tenants seeking consistency.

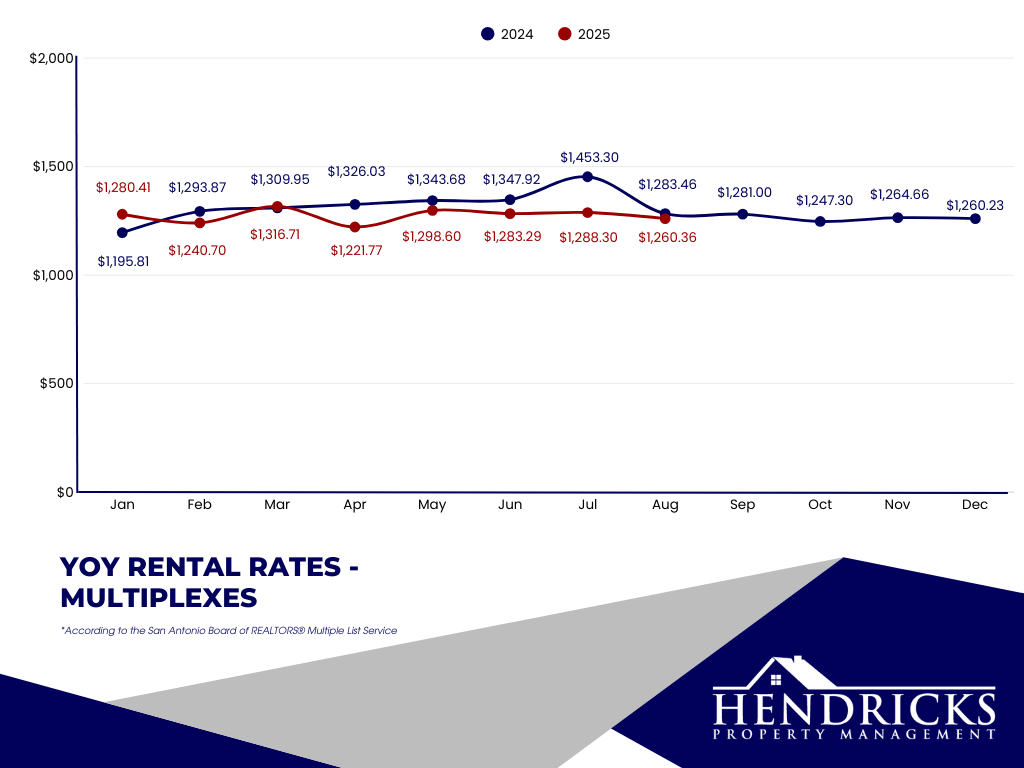

Increased Demand for Multifamily Units

Multifamily units are experiencing increased demand, as evidenced by a 9% rise in days on market compared to last year. Despite this increase, the average rental rate for multifamily units remains competitive at $1,347.92, making them an appealing choice for renters looking for affordability and flexibility.

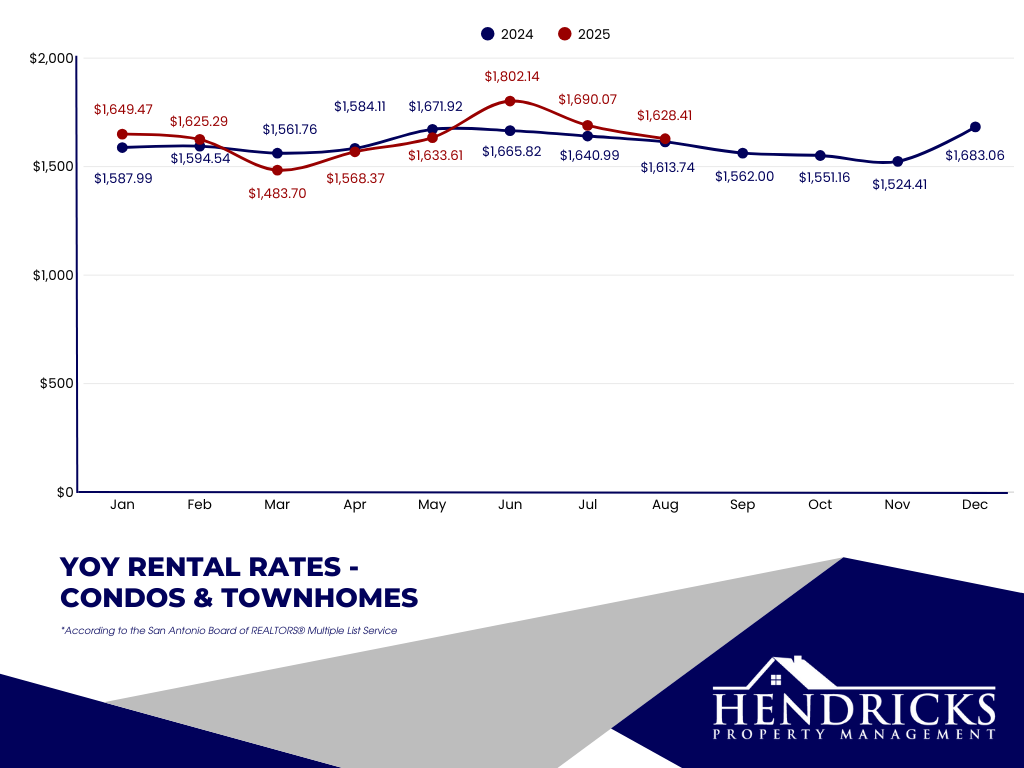

Gradual Uptick in Condo and Townhome Rentals

Condos and townhomes have seen a moderate rise in days on market, up 3.39% year over year. However, the average rental rate for these properties is $1,665.82, indicating a robust demand within this segment. Investors should note the potential for steady returns in this market niche.

Conclusion

The San Antonio rental market research in June 2024 presents a mix of stability and emerging trends. Single-family homes remain a steadfast choice, while multifamily units and condos continue to attract interest with their competitive pricing. The decrease in active listings highlights a tightening market, which may impact rental dynamics in the coming months.

For real estate investors, understanding these trends is essential for making informed decisions. Stay ahead of the curve by keeping an eye on the evolving landscape of the San Antonio rental market research.

If you are looking to capitalize on the opportunities in the San Antonio rental market, consider subscribing to our newsletter for the latest updates and expert insights. Don't miss out on the chance to make the most of your investments in this dynamic market.

Published June 17, 2024

May 2024 Market Statistics for San Antonio Rental Homes

The San Antonio rental market is flourishing, presenting lucrative opportunities. Understanding the latest market trends and statistics can help you make informed decisions, whether you're looking to invest in new properties or manage existing ones. Let's take a closer look at the current state of San Antonio rental homes.

Increase in Rental Demand

San Antonio continues to experience a surge in rental demand which is typical for the time of year. May through August is when we see the most turnover and movement as people try to get settled in before school starts in the fall.

Average Rental Prices

The average rental prices for San Antonio rental homes have shown a moderate increase. In May 2024, the average monthly rent for a single-family home stands at $1,950 reflecting a -0.9% decrease compared to the same month last year. This trend is indicative of market balance and economic stability, and is consistent with interest rates remaining on hold.

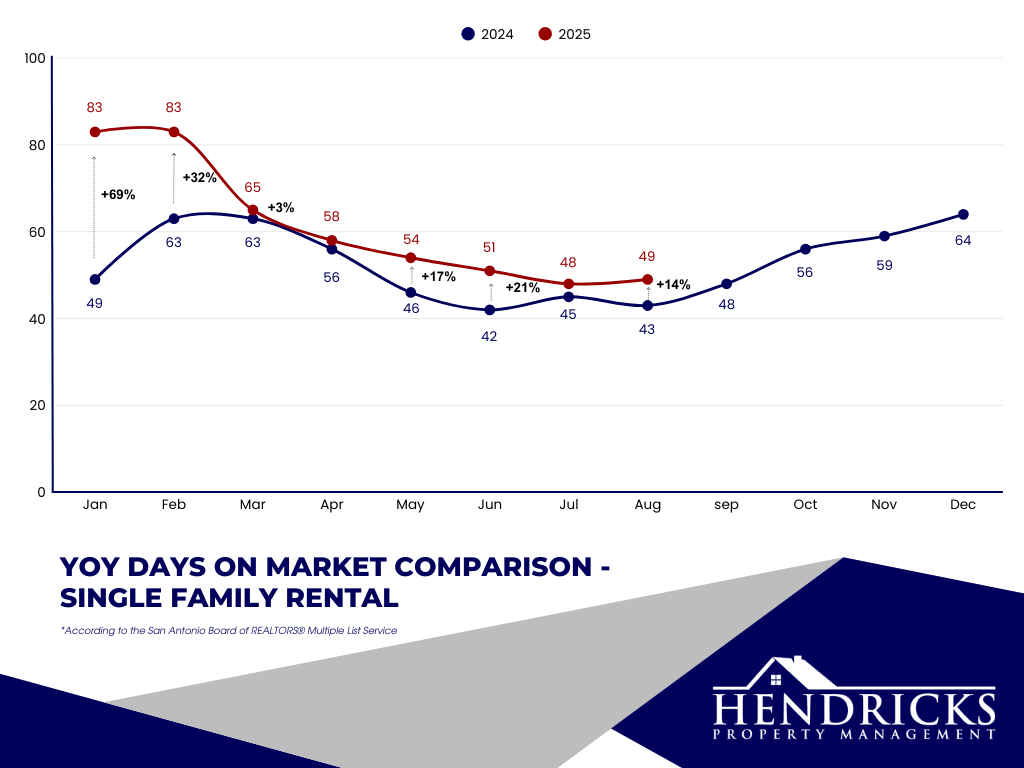

Days on Market

San Antonio rental homes Days on Market rate is dropping quickly for single family and condominium style housing, while multiplex housing is decreasing at a slower rate. For single family, San Antonio peaked at 63 days on market for both February and March. Condominiums hit a high of 97 days on market in March, while multiplexes hit their peak in February at 74 days.

'Days on Market' figures for San Antonio rental homes are showing positive trends, but leasing properties is still taking longer than usual. In a crowded rental market, there’s one primary factor we can adjust to lease properties more efficiently and reduce vacancy: list price. Adjust the price to make your property stand out as the best deal.

Patience will also be required. Understand that leasing might take longer due to more choices for renters and their decision-making process. Setting realistic expectations and acknowledging this scenario is vital, which is why we are sharing it here. If you are between tenants right now, it would be a good time to consider upgrades to your property to put your listing ahead of similar properties. This approach will ensure long-term success through effective tenant retention.

Overall Health of San Antonio Rental Homes Market

A healthy balanced market typically has about 6 months of inventory according to NAR when discussing home sales. However, when looking at rentals, especially in urban areas, the benchmark comes down to about 3-4 months. If we were in a balanced market, it would mean there is enough supply of rental properties to meet the demand, providing a situation where neither landlords nor tenants have a significant advantage. As you can see in the data set below, we are down from last year for the total number of properties listed, and we saw a major spike in the month of May for home many homes were leased. This directly affected the months of inventory we have available in San Antonio. We have had a very steady increase is rental rates so far this year, but given these circumstances, San Antonio rental homes will likely see a sharp spike in rent amounts for the next two months before following the trend downward after the typical leasing season slow down. This is simple supply and demand. Another item to note, San Antonio’s real estate market has slowed down on the sales side. There has not been a massive sell off of rental units. The lower amount of rental properties on the market in 2024 is most likely because fewer people are choosing to move. As a landlord, this is a good thing. Turnovers cost money in labor and holding costs while on the hunt for the next qualified tenants.

Investment Opportunities

San Antonio's rental market offers promising investment opportunities. The city's diverse neighborhoods cater to various tenant preferences, from urban living in downtown areas to suburban lifestyles in the outskirts. Investors can capitalize on this diversity by targeting properties that align with the current demand trends.

Stay Informed About Market Trends

The real estate market is dynamic, and staying informed about the latest trends and developments is essential. Regularly reviewing market reports, attending industry events, and subscribing to real estate newsletters can help you stay ahead of the curve and make proactive investment decisions.

Work with Experienced Professionals

Partnering with experienced real estate professionals can provide valuable insights and guidance. Since Hendricks Property Management is a full service property management company, we can help you make informed decisions, ensuring a successful investment experience.

Focus on Professional Property Management

Effective property management is key to maximizing your rental income and maintaining the value of your investment in your San Antonio rental home. Hiring a reputable property management company can help you handle tenant relations, maintenance issues, and legal requirements, ensuring a hassle-free ownership experience.

The San Antonio rental home market in May 2024 presents a wealth of opportunities for real estate investors and homeowners. With increasing rental demand, competitive rental prices, and low vacancy rates, the market is primed for growth and profitability. By conducting thorough research, working with experienced professionals, and focusing on effective property management, you can maximize your investment in San Antonio rental homes.

Ready to take the next step? Learn more about how our services can help you succeed in the San Antonio rental market. Contact us today to get started!

Published May 13, 2024

San Antonio Rental Market Update: A Spring Overview

In our commitment to keeping property owners informed and empowered, we are pleased to present a detailed update on the San Antonio rental market, covering the months of February, March, and April. This analysis aims to provide you with the insights necessary to make informed decisions regarding your rental properties. Read on to see the numbers compared side by side.

A Look at the Numbers

The San Antonio rental market has shown remarkable resilience and dynamism over the past few months. Here is a brief overview of the key statistics:

February: The month remained in rental demand, with average rent prices seeing a modest rise compared to the previous month in the single family space, while duplexes, triplexes, and quadraplexes posted a sharp increase. Condominiums remained steady Days on market increased in all 3 categories. This is typical for this time of year as we approach the busy season for real estate.

March: March saw steady increases in rental prices for single family, a slight increase for multiplexes, while condominium and townhome rates slipped slightly. Days on market peaked in March for single family and condominiums and townhomes, and held steady for multiplexes.

April: Rental rates in April continued a steady increase for single family, multiplexes, and condominiums and townhomes recovered from the March dip. Days on market is starting to fall in all three categories with the most drastic decrease being in the condominiums and townhomes category.

Overall market statistics for rental properties: When looking at the overall picture, rented listings, active listings and new listings seem to be following the 2023’s trend line, and we are down to 2.2 months of inventory. July 2022, housing inventory was at 2.1 months, but May and June of 2022 we were at 1.8 months of inventory. The Feds raised interest rates for the first time in March 2022. We saw a tight squeeze in inventory the following months, then we saw almost a solid year hanging out in 3+ months of inventory.

Implications for Property Owners

The data from the past three months suggests a favorable environment for property owners in San Antonio. These data points indicate a strong rental market that can potentially offer increased returns on investment.

However, it's important to approach this opportunity with a strategic mindset. Understanding the nuances of the market and adapting your property management practices accordingly will be key to maximizing your success. Consider the following strategies:

Pricing: Stay competitive by setting rent prices that reflect the current market conditions while ensuring they align with the value your property offers. Listen to your trusted advisors at Hendricks Property Management. We have been doing this a long time and understand that pricing your property outside of market rates will cause your property to sit vacant for longer.

Property Improvements: Investing in thoughtful upgrades can enhance the appeal of your rental property, attracting a larger pool of potential renters. We can help you with any improvements you wish to make on your rental home.

Marketing: Effective marketing efforts can increase visibility for your property, helping you reach a broader audience of prospective tenants. We use high quality images, the power of the MLS which is a specialty to the San Antonio market, social media, and a dedicated leasing team that can meet prospects within an hour of showing interest in your property.

Tenant Relations: Prioritize building strong relationships with your tenants through responsive communication and reliable service, fostering a positive living experience that encourages long-term occupancy. Hendricks prides itself in relationship building. We do not want anyone to feel like they are just a number. Maintaining personal relationships with all of our clients is a priority that sets us apart from the rest.

Conclusion of the Spring San Antonio Rental Market

The San Antonio rental market's performance in the first quarter of the year presents a promising outlook for property owners. By staying informed and adopting a proactive approach to property management, you can leverage these trends to your advantage. We understand the importance of having access to timely and accurate market data. Rest assured, we will continue to monitor the San Antonio rental market closely and provide you with the updates you need to make the best decisions for your rental properties. For personalized advice and assistance, feel free to reach out to our team. Together, we can achieve your property management goals and ensure your success in San Antonio's thriving rental market.

Days on Market

Rental Rate Comparison

General Market Health Indicators

Published February 27, 2024

January 2024 Rental Housing Stats in San Antonio, Texas

The Federal Reserve has kept the short-term interest rate stable at 5.375%. While change is not immediate, the horizon gleams with potential relief, as the Fed has hinted at several cuts in the latter part of 2024. This forecast has ripples already lapping at the shores of the housing market, affecting real estate investors and homebuyers in San Antonio. Let’s take a deep dive into the housing statistics for January 2024 to see how this is affecting the rental market.

San Antonio's real estate sales have been robust, showcasing the city's overall desirability and growth. This seemingly positive trend has a nuanced impact on the rental market. With each home sold, the supply of potential rental homes may decrease, intensifying the demand for available rentals. While this might hint at a rental price increase, offering an advantage for landlords, there's other factors to consider.

For the real estate investor, these market conditions underscore the importance of strategic property selection and targeted improvements that make a rental offer stand out. Additionally, staying abreast of local development projects and zoning changes can offer foresight into neighborhood trajectories that sway rental desirability and rates. Below you will see the trending data from 2023. Interestingly enough, after all the turbulence over the last year, we are sitting in the exact same position we were the year before in almost every data set.

Investors and future landlords might question: does a surge in home sales indicate a shift towards homeownership, thereby reducing rental demand? Potentially, but other factors such as local job growth, economic stability, and migratory patterns contribute to sustaining and even heightening rental needs. In San Antonio, burgeoning industries and a flourishing job market continue to attract residents who may initially seek rental accommodations.

This next set shows the overall numbers of the rental housing market in San Antonio without breaking down it down by housing type.

In comprehending rental market dynamics, we must consider the tenant's profile. San Antonio's rich variety of higher education institutions, along with military bases, such as Joint Base San Antonio, curates a diverse tenant pool, including students, professionals, and military personnel, many of whom prefer or require temporary renting over homeownership.

For the real estate investor, these market conditions underscore the importance of strategic property selection and targeted improvements that make a rental offer stand out. Additionally, staying abreast of local development projects and zoning changes can offer foresight into neighborhood trajectories that sway rental desirability and rates.

Real estate sales in San Antonio weave a complex story, one in which the outcomes for the rental market are dynamic and multifaceted. For investors looking to anchor themselves in San Antonio's real estate scene, a combination of diligent market research, property upgrades, and attuned customer service remain key strategies for ensuring a sound return on investment. Whether eyeing the downtown horizon or the suburban expanses, San Antonio's rental market invites a proactive, educated approach from realty investors.

For personalized investment advice and thorough market analytics, consult with us to see if our market is right for you. Diving into San Antonio's promising real estate investment opportunities has never been more reassuring.

Published January 3, 2024

December 2023 San Antonio, Texas Rental Market Stats

High Level Overview

Days on Market and Rental Rate Comparisons

General Market Health Indicators

Published December 14, 2023

October and November 2023 Rental Statistics for San Antonio

High Level Overview of General Market Statistics

Published October 24, 2023

September 2023 San Antonio Rental Market Statistics

High Level Overview of General Market Statistics

Published March 3, 2023

January & February 2023 San Antonio Rental Market Statistics

Published January 2, 2023

November & December 2022 San Antonio Rental Market Stats

Published November 1, 2022

October 2022 San Antonio Rental Market Statistics

Published September 30, 2022

September 2022 San Antonio Rental Market Statistics

Published September 1, 2022